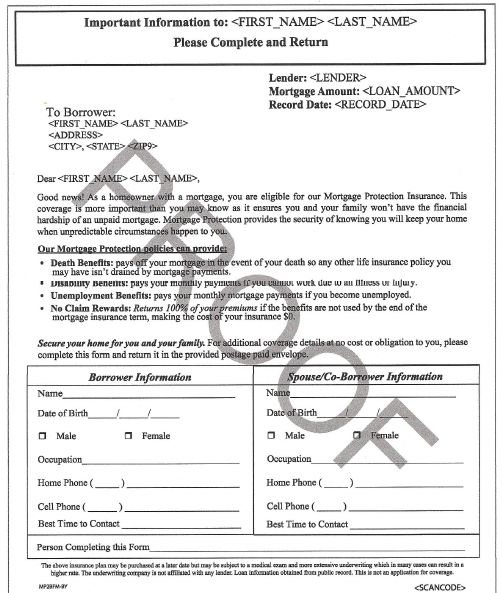

how do you know if you have mortgage protection insurance

If you just took out a mortgage, we'd advise you to look at term life insurance that would factor in your mortgage and income replacement to help care for those you'd leave behind. The typical recommendation is to have 8-10 times your income in a 20 or 30-year life insurance policy.

Does this sound like a great idea, or is it a hoax?